HOME

ARTICLE

PAST ARTICLES

CONTACT

March 20, 2023

A REAL REAL ESTATE DISASTER

A Matter of Magnitude

The above mentioned bubble eventually burst and was AGAIN reflated and in some parts of the country (as of this writing) it appears to be popping again. The earlier episode involved mostly the housing market with some spillover into other areas of the economy but was primarily confined to that sector, but not this time.

On this second go-around the commercial real estate market may very well take the bigger hit, that's not to say that the housing market won't experience some degree of damage, particularly in regards to collapsing home prices, but the collapse of the commercial real estate market in terms of its destructive force to that sector, and to the economy in general, will be by magnitudes MUCH greater.

It must be remembered that, commercial real estate firms had access to more money to "play with" via loans than did home buyers, so in terms of dollars and cents the loss of wealth for those who lost their homes during the last housing collapse will be minuscule in comparison to the loss of wealth to be experienced by over-leveraged commercial property owners, especially during a recession, which many believe we are already in, losses that have yet to be fully realized.

When the housing crisis initially hit the U.S. in 2008 the cause for the most part was attributed to bad mortgages made to people who could not afford them, but truth be told, the crisis stemmed from other problems that existed at the same time as well, such as an environment of unusually low interest rates courtesy of the Federal Reserve Bank, slow to respond regulators to a developing housing bubble, banks and other financial institutions that profited from the bubble as it grew, and a consenting public that participated in inflating the bubble. It turned into a feeding frenzy, but that was then, this is now, and here we go again.

The Interest Rate Factor

When interest rates were at zero there was very little concern to take out multi-million or billion dollar real estate loans and engage in development deals that seemed to make financial sense at the time, but that was in the past. Rates are now rising (for now) and that's creating a problem because in today's environment rising rates makes it more expensive to raise fresh capital for new, or existing projects.

Typically, rising interest rates would indicate robust economic activity driven by a thriving economy, evidenced by rising wages and salaries accompanied with higher rates paid on bank deposits e.g. savings accounts, CDs, money market accounts etc., that spur increased savings and investment, but that's not exactly what's happening now. Currently banks are paying practically NOTHING on savings accounts, with that in mind and in the current environment, rising rates appear to be less indicative of a supposedly "robust" U.S. economy and more reflective of an over-indebted financial system, a system whose participants are demanding higher interest rates to compensate for their increased risk in holding onto U.S. dollars that continue to be debased via excessive money printing a.k.a. QE, a debasement that continues to erode away the purchasing power of the currency.

Specifically as it relates to the real estate market, having high debt in a rising interest rate environment makes it difficult for commercial developers, construction firms, property owners and others in that space to finance existing debt and/or to begin or finish projects. This is particularly true when the rate is variable, but as we shall see, even fixed rate debt can become difficult to finance.

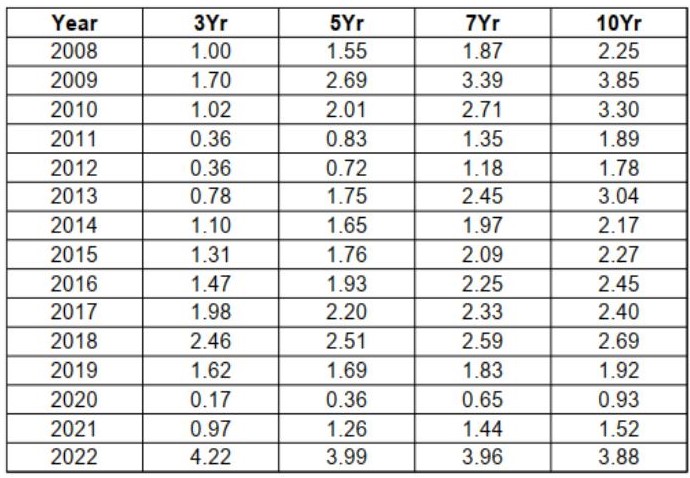

Commercial property owners who borrowed at a low fixed rate years ago and/or who issued low yielding bonds did benefit via low financing cost, but today it would be much more expensive to take out those same loans or issue those same bonds with current rates (as of this writing) where they are. Relatively speaking, it is true that a three to four percent interest rate is still quite low but not when compared to rates that in the past (e.g. 2008) were much lower.

With the below chart I created, I compared the end of year U.S. Treasury rates for its three, five, seven, and ten year securities dating back from 2008 to 2022, needless to say, rates ended MUCH higher at the close of 2022 than ALL the preceding years. This fact has serious consequences for the commercial real estate market going forward, as well as for foreign markets, because as important as Treasury rates are it must be understood that interest rates globally, including Treasury rates, are all queued off of U.S. central bank rates, set by the Federal Reserve.

So today, despite interest rates being at their highest levels going back nearly fifteen years, commercial real estate developers and construction firms are still able to borrow, thus much of the construction projects we still see going on in different parts of the country.

(Boston, MA 2023)

(Boston, MA 2023)

So the question is if rising interest rates are not the disaster that real estate participants and investors have to contend with (as yet), what is? Rising inflation.

The Inflation Factor

Rising inflation has the effect of crimping consumer spending as nothing else does as prices for goods and services go up, and nothing more negatively affects consumer sentiment than rising prices. For better or for worse, the foundation of the U.S. economy and by extension business revenues and profits, is dependent on consumer spending. And it must be remembered that rising prices, when steep enough will result in reduced economic activity and growth.

As it relates to the real estate market, it can be said that a developer can build or renovate a million homes, shopping malls and centers, office buildings, parking lots, etc., but if the cost for the consumer or business to buy, lease, or rent these properties is out of their reach that lost revenue will be reflected on the balance sheet of the developer and/or property owner (absent any accounting tricks). This is despite any low, fixed rate loan that was used to finance the construction of, or to renovate the properties. Simply put, if enough sales, rental, or leasing revenue is not flowing in to cover the interest payments on the loan(s) it will lead to a default on those loans and that's when the REAL real estate disaster begins to unfold, particularly as the pace of defaults and bankruptcies accelerates.

So, as one can see, a collapse in the real estate market can occur in a low interest rate, yet high inflationary environment, an environment in which buying, renting, leasing, constructing, or renovating a property(ies) is much more vulnerable and sensitive to inflationary pressures than interest rates alone. After all, what advantage is their in having a low interest rate when the price of what I want to buy or finance is too high.

What is being described above are two opposing forces working against each other; low interest rates which are meant to encourage borrowing and spending and rising inflation which discourages it. In the end, no level of low interest rates will be enough to motivate people and businesses to buy, borrow and spend at any significant level, but what will happen is a pull back on consumption, the very opposite of what low interest rates were meant to accomplish.

At present there should be serious concern on the part of developers and anybody else involved in the real estate market, especially when the possibility of interest rates rising further is real, becasuse as mentioned earlier it would make it more expensive to raise fresh capital for new or existing projects.

What Happens When...

In light of interest rates rising further, one concern and consideration should be what happens when a project is completed but not enough rental or lease agreements have been signed, or are canceled. What happens to the real estate market if and when inflation starts seeping into the real economy in a more pronounced way, causing maintenance supplies, building and construction materials, fees charged and other operational expenses to all skyrocket higher?

What happens when insolvent, broke, and desperate local governments strapped for cash begin raising property taxes much higher? How do property owners handle the need to pass along those increased costs to their commercial and residential tenants who in response may either move out, set up shop elsewhere, or begin defaulting on their rental payments, or worse go out of business, while others become homeless? These are all possibilities that can occur if inflation breaks out in an uncontrollable way that even the central bank can't contain through intervention, leading to a panic in the real estate market that results in an epic crash worthy of mention in history books.

Distorted...

If you've ever been inside a mirror house at an amusement park you know how disorienting and confusing it can be to find your way out, it can even be scary if you're a child. It's that kind of feeling and experience one gets when looking at the current economy.

We read, see, and hear about how well the economy is doing, but at the same time we see paradoxes and contradictions that can be confusing to many people, but understanding what's behind the confusion can go a long way in calming some of those fears.

Again, when you're in a mirror house you should expect confusion, things being distorted, and so it is with an economy that's been fattened up on a diet of cheap money made possible via ultra-low interest rates and stimulus checks for far too long.

Our central bank has a trading desk which is uses to perform Open Market Operations (OMOs) and without a doubt it's uses it, being actively involved in the financial markets buying and selling all types of market securities. Whether it be currencies, ETFs, stocks, bonds, commodities, indexes, puts, calls, options, warrants, futures contracts etc., whatever it needs to buy or sell the central bank is there to do it.

The Federal Reserve can create "facilities" and new rescue programs instantly to accommodate and address whatever financial problems arise, whether or not they help or work is another question, but the fact that they can do it is established. Therefore, what this means is that market signaling tools such as charts, graphs, historical data, investing software programs, algorithms etc., can't be fully relied upon or trusted to provide accurate, clear data in today's market. This is data that market analysts, retail investors, economist, money managers, traders and other Wall Street players all use and rely on to determine market moves and direction.

Without exaggeration our financial system in many ways is broken, thus many investors are experiencing confusion, fear, and doubt.

The reality is that, the Federal Reserve can "paint the charts" to read whatever it wants them to, even if only on a short-term basis, confusing most investors in the process as they scratch their heads trying to figure out "what the hell is going on!" why the markets are behaving so irrational, disorderly, and crazy.

Moreover, the central bank understands that most market participants (especially institutional investors) think and react as a herd, buying and selling primarily with a short-term time horizon in view, therefore, it can lead them around by their collective noses in the direction it chooses for quite some time, leading to extreme market volatility in the process.

Extreme market volatility, distortions, Fed interventions, and mixed signaling is like being intoxicated, drunk inside a mirror house making irrational moves and decisions out of fear (and greed), all the while bumping into mirrors, tripping, stumbling, falling down trying to find one's way out.

Wall Street is truly a casino, but outside the casino, for the man on the street, it's also confusing, especially when he/she looks on their right side and see construction projects underway and on the left side they see for lease, for sale, and for rent signs in the windows of many shuttered businnesses, to say for sure, it's another distorted, yet sad reality.

(Boston, MA 2023)

In this alternate universe we hear and read about people working from home a.k.a. remote commuting, workers not wanting to return to the office, underscored by a new phenomeonon (or fad) known as "quiet quitting". At the same time (as of this writing) thousands of workers are and have been laid off, yet we read and hear about a worker shortage. It's important to note that, many of the recent jobs that are being lost are high paying technology and financial servives jobs, but the demand for bartenders and waitresses is high, which are not typically high paying jobs compared to the former. This too can be confusing to some.

To sum things up, the distortions to be found are on both Wall Street and Main Street, in some instances they are obvious while others are more stealth, yet are there to be seen by those paying attention. Unfortunately, in the years to come, this "quiet financial crisis" will become more noisy, noticeable, and severe--we can only expect things to become more confusing and disorienting as the financial markets and economy both become more unstable, unglued. But one ray of hope is to remember that, even in a mirror house you can find your way out, if you recognize you're in one, understanding its distortions while safely navigating your way through it.

FEEDBACK

Feel free to share your comments by clicking the link below.